It is an unusual or a typical cost whose occurrence is usually irregular and unexpected and due to some abnormal situation of the production. Abnormal cost arises due to idle time for some heavy break down or abnormal process loss. They are not considered in the cost of production for decision making and charged to Profit and Loss Account. Sunk costs will remain the same irrespective of the alternative selected. Thus, it need not be considered by the management in evaluating the alternatives as it is common to all of them. When using lean accounting, traditional costing methods are replaced by value-based pricing and lean-focused performance measurements.

NGAD: America’s 6th Generation Warplane Could Be a Game Changer

Manufacturing costs – incurred in the factory to convert raw materials into finished goods. It includes cost of raw materials used (direct materials), direct labor, and factory overhead. You can break down these basic cost components in SAP S/4HANA Finance into a maximum of 120 components as needed. The origin group in the Costing 1 view allows you to report at a more detailed level than cost elements, so you might use this to separate different types of material costs.

Fixed Costs

Naturally historical costs must be adjusted to reflect current or future price levels. Accounting Costs – this is the monetary outlay for producing a certain good. Accounting costs will include your variable and fixed costs you have to pay. For example, if you produce more cars, you have to use more raw materials such as metal. So basically there are three broad categories as per this classification, namely Labor Cost, Materials Cost and Expenses. They help ascertain the total cost and determine the cost of the work-in-progress.

- This time, Trump won all three states, crushing Democrats’ hopes that Harris could find a path to victory despite early election night losses in the southern states of North Carolina and Georgia.

- On the basis of careful analysis and estimation, standard costing establishes an array of acceptable costs that an organization expects to incur, and monitors actual costs against these standards.

- Financial decision-making is based on the impact on the company’s total value stream profitability.

- Fixed costs examples include yourmonthly rent, salaried employees, straight-line depreciation asthese amounts do not change based on volume.

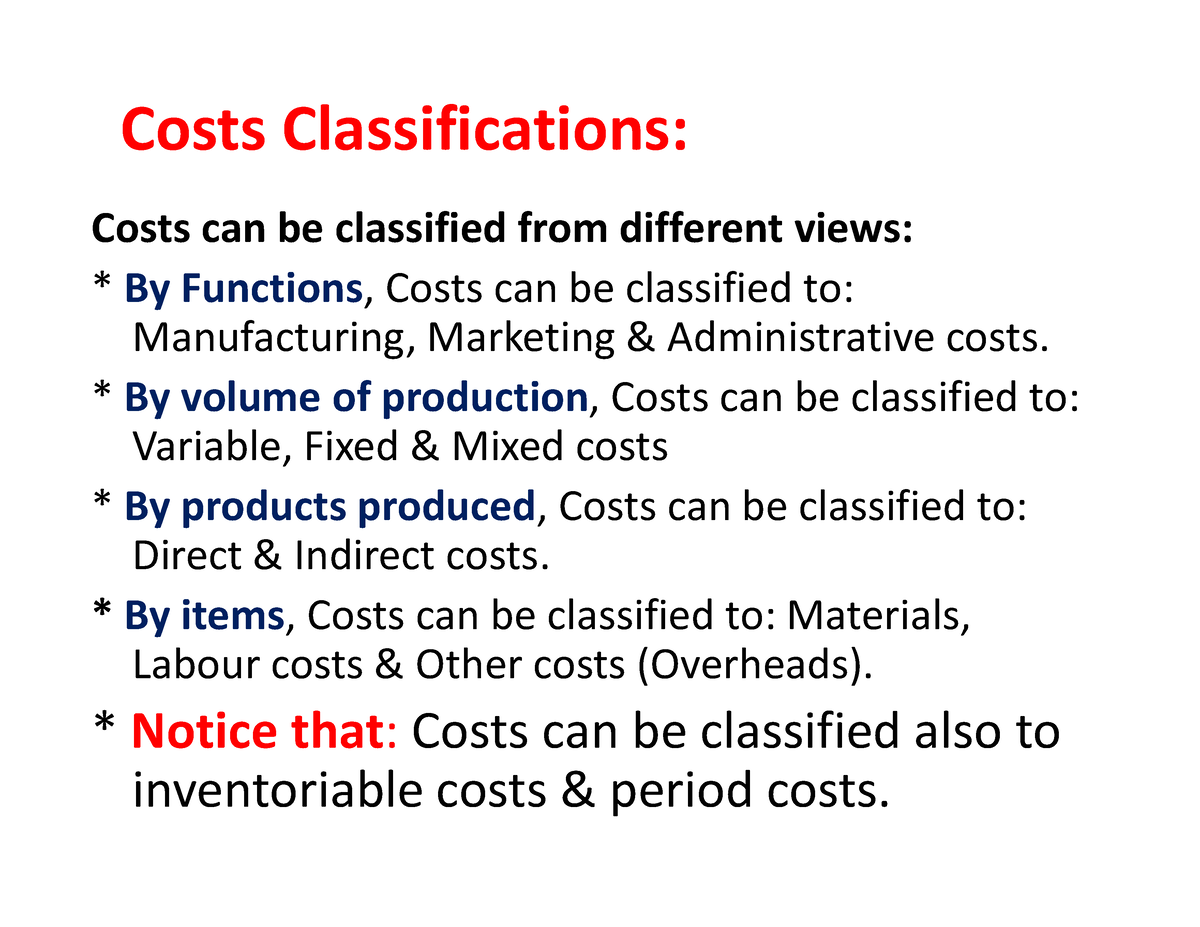

Cost Classification

These types of costs are the difference between costs for the corresponding items under each alternative being considered. An indirect cost is a cost that cannot be identified with specific segments of operations. Standard cost – predetermined cost based on some reasonable basis such as past experiences, budgeted amounts, industry standards, etc. Fixed costs will not change with the volume of any product manufactured. Variable costs, however, vary with changes in the level of production.

Avoidable cost can be identified with an activity or sector of a business and which would be avoided if that activity or sector did not exist. It refer to costs which can be reduced due to a contraction in the activities of a business enterprise. It is the net effect on costs that is important, not just the costs directly avoidable by the contraction. The sunk cost is one for which the expenditure has taken place in the past.

Advancements in technology may influence cost structures, requiring periodic updates to classification methods. Expenses related to marketing, sales commissions, and distribution of products to customers. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

However, in management terminology, cost refers to expenditure and not to price. Service organizations do not normally hold inventories of any tangible products that are for sale best invoice management software to streamline ap process or resale. An example would be the music system inside a high-performance motor car, the cost data for which can be obtained from the bill of materials issued by the supplier.

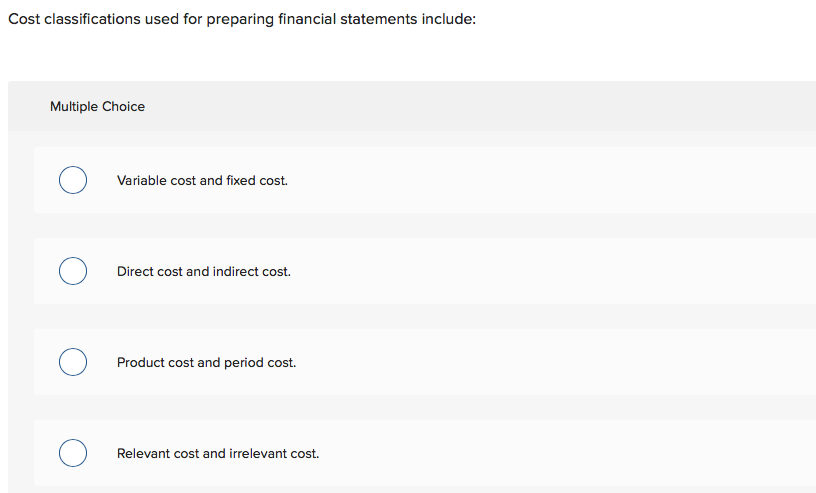

Period costs are expensed during the time period in which they are incurred. They are costs that are treated as expenses of the period in which the costs are incurred. Fixed costs – costs that remain constant regardless of the level of activity. Examples include rent, insurance, and depreciation using the straight line method. Period costs – are not inventoriable and are charged against revenue immediately. Period costs include non-manufacturing costs, i.e. selling expenses and administrative expenses.

This follows from the fact that the cost of any product equals the cost of direct materials, direct labor, and factory overhead. The distinction between variable costs and fixed costs underpins how we might view costs changing in response to changes in organizational activity. The normal cost is normally incurred at a given level of output in the conditions in which that level of output is achieved.

No responses yet